stock market bubble definition

By the time. When they fall they do so quickly and often below the starting value.

A stock market bubble influences the market as a.

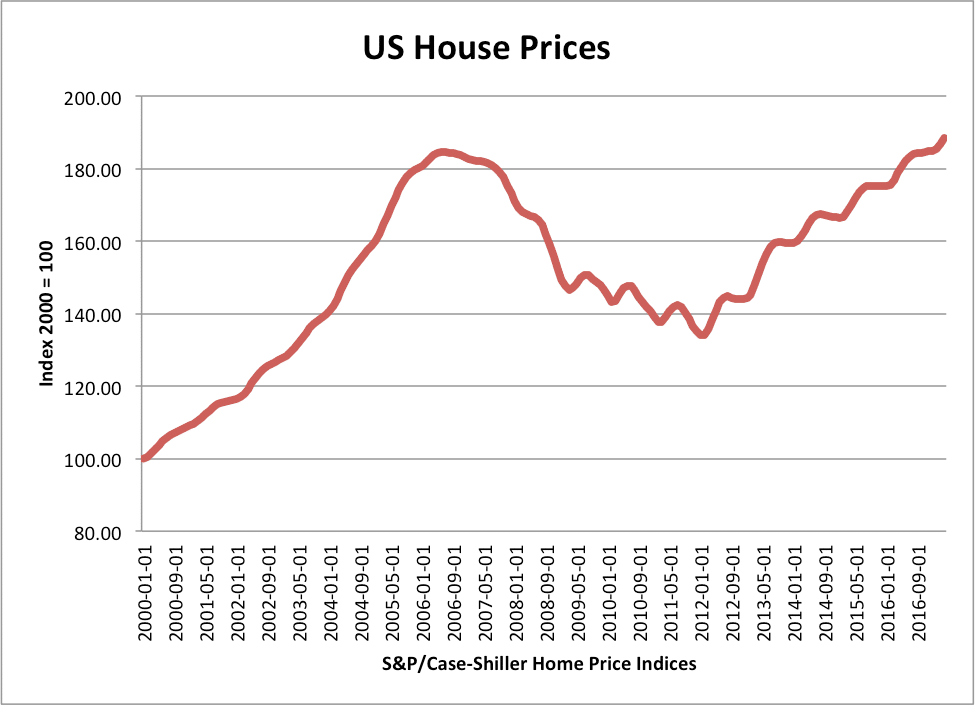

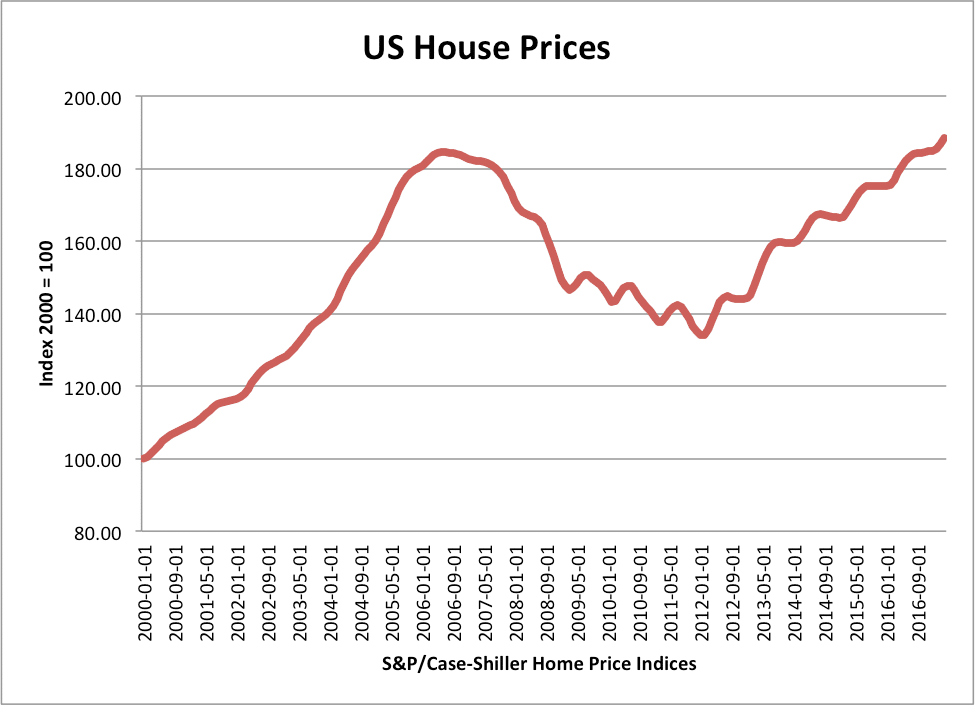

. Precipitated by a housing bubble which burst US. I also offer heartfelt gratitude to my mum dad and younger sister who since I was a. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

When investors flock to an asset class such as real estate its demand. Usually they are falling below the fair value. And a bubble is also defined in two ways.

Stock market bubbles involve equitiesshares of stocks that rise rapidly in price often out of proportion to their companies fundamental value their earnings assets etc. Stocks were only 27 overvalued when it began. Typically prices rise quickly and significantly growing far beyond their previous value in a short period of time.

While theres no specific numeric definition of a stock market crash the term usually applies to occasions in which. Inspiration for future research on stock market bubbles. In a new working paper Johns Hopkins Carey Business School Associate Professor Nicola Fusari and two co-authors propose a new method for determiningin real-timewhether a spike in a stock price is in fact a bubble.

Market Bubble Law and Legal Definition A stock market bubble is a type of economic bubble wherein there will be a spike in asset values within a particular industry commodity or asset class. Behavioral finance theory attributes stock market bubbles to cognitive biases that lead to groupthink and herd behavior. It is caused by exaggerated expectations of future growth price appreciation or other events that could cause an increase in asset values.

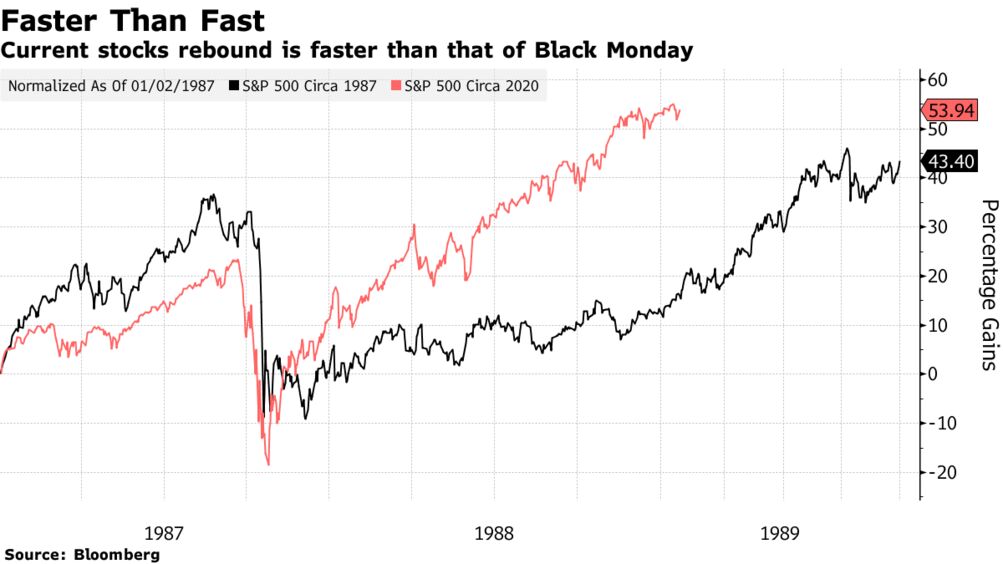

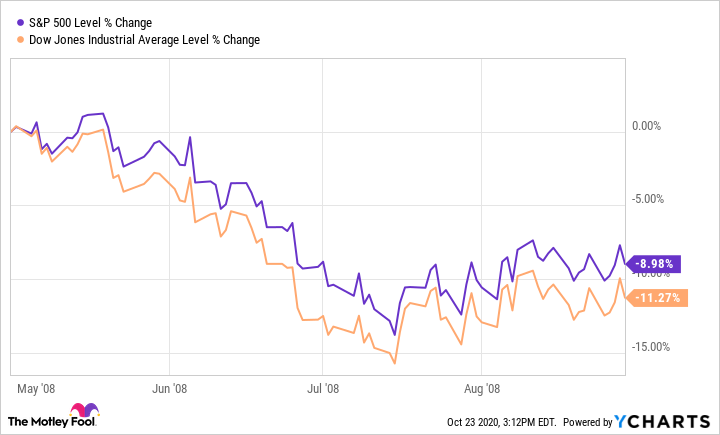

A stock market bubble is a period of growth in stock prices followed by a fall. Nonetheless stocks proceeded to sink ultimately losing 5378 from peak to trough. A stock market bubble refers to a surge in share prices to levels significantly above their fundamental value.

This second definition is chosen so as to include the famous US bubbles of the 1920s and 1990s. Typically a stock market bubble is created when asset prices surge to levels that greatly exceed the their intrinsic value. An asset bubble is when assets such as housing stocks or gold dramatically rise in price over a short period that is not supported by the value of the product.

A bubble occurs when investors put so much demand on a stock that they drive the price beyond any accurate or rational reflection of its actual worth which should be determined by the performance of the underlying company. What is the definition. A stock market crash occurs when there is a significant decline in stock prices.

A stock market bubble is a type of economic bubble taking place in stock markets when market participants drive stock prices above their value in relation to some system of stock valuation. We are talking about a stock market bubble when the prices of stocks rise fast and a lot over the short period and suddenly start to drop also quickly. The hallmark of a bubble is irrational exuberance a phenomenon when everyone is buying up a particular asset.

The stock market bubble is a type of investing phenomenon that demonstrates the frailty of some facets of human emotion. A stock exchange to make money on the stock market a stock market crash when prices of shares fall suddenly and people lose money Collocations The economy Topics Money b2 Oxford Collocations Dictionary Definitions on the go. Because there is disagreement between market participants as to that value bubbles can be hard to detect as they are taking place.

Estimated bubbles at the market level enable us to analyse bubble changes over time among 37 countries across the world which helps further examine the relationship between economic factors eg. Fusari an expert on theoretical and empirical asset. ˈstɑːk mɑːrkɪt also market the business of buying and selling shares in companies and the place where this happens.

The phrase stock market bubble does not have a standard definition but the current market is the closest we have been to a bubble since the internet frenzy in 1999-2000. They based the method on the options written on a stock during trading. Wikipedia defines a stock market bubble as trade in high volumes at prices that are considerably at variance with intrinsic values Or in plain English asset prices are sky high but people keep jumping on the bandwagon Why they do so is really a question more for psychology than for economics.

Once a bubble bursts a stock market crash often follows. 1 a single year in which a market value or cumulative return increased by at least 100 and 2 a period of three years over which the market increased by 100. A stock market bubble is a period of growth in stock prices followed by a fall.

In the 1990s investors bought stock in Internet companies in a speculative manner based on the idea that one day these companies would produce revenue and profit - Known as the DotCom bubble this represented a time when VC or venture capital companies invested in startups without the typical due diligence process or caution that might normally be employed.

Bubble Expert Grantham Addresses Epic Stock Euphoria Bloomberg

How To Detect A Market Bubble Financial Times

/stockmarketmove.asp_V2-49c8238843354b45bfc11fa5fec8abef.png)

What Causes A Significant Move In The Stock Market

Bull Vs Bear Market What S The Difference The Motley Fool

How Do Asset Bubbles Cause Recessions The Motley Fool Stock Market Crash Stock Advice

What Are Stock Market Corrections The Motley Fool

Watch Trillion Dollar Man Dan Pena Says The Market Is Set For A 40 Crash And New Investors Will Get Wrecked He Explains How You Should Be Positioned And S Marketing

What Are Stock Market Corrections The Motley Fool

What Are Some Past Triggers Of A Recession What Are Some Reasons That Spark Off A Recession Let S Take A Look At Some Past Causes F Meltdowns Recess Bubbles

What Is A Bear Market And How Should You Invest In One The Motley Fool

Bull Vs Bear Market What S The Difference The Motley Fool

Asset Bubbles And Where To Find Them

6 Reasons This Tech Bubble Is Bursting The Motley Fool

Avoid Looking At Stock Investing As A Scheme To Make Money Quickly You Will Need To Spend Time Lear Stock Market Money Making Hacks Stock Market For Beginners

Types And Causes Of Financial Bubbles Economics Help

Measuring The Ivy 2020 First Take Markov Processes International Style Analysis Ivy League Schools Measurements

What Is A Bear Market And How Should You Invest In One The Motley Fool

/dotdash_INV_final-Tech-Bubble_Feb_2021-01-f60580df62c24a79830dfb739e76af50.jpg)